If you are a founder, CRO, CSO, Sales Lead or VP Sales at a DACH based B2B company with a complex offer that is highly explanatory (and needs to be sold by people) this is for you.

Most companies we work with have grown in the past years through their own network, referrals or inbound requests. Some had great experiences with cold calling or going to industry events, fairs. These channels decreased in efficiency over time, and it’s getting harder and harder to actually speak with enough relevant people. Going from a first meeting to winning an actual new customer seems even more difficult than before.

It can feel like:

Everyone has budget cuts

Nobody is ready to make an actual decision, they just want to hear what’s going on

The amount of stakeholders involved to make a buying decision for explanatory products is constantly increasing

CFOs and Finance people get more involved and buying decisions are more focused on ROI

Sophisticated buyers are speaking to multiple of your competitors and prices get driven down

More and more competitors emerge, and it gets harder to position with a clear USP

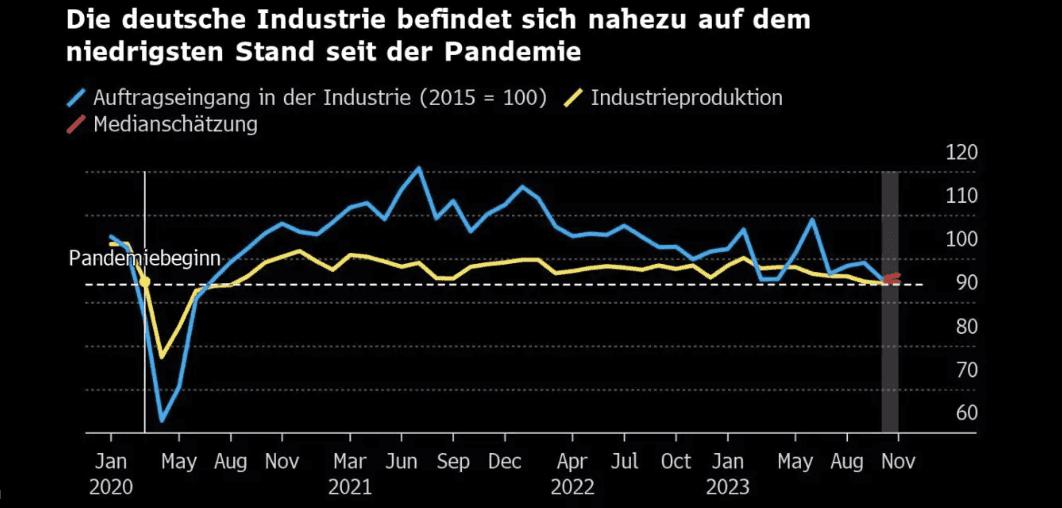

If you have been around for more than 8 years you probably also experienced different macro-environments and their impact on buying decisions.

In 2024 the macroeconomic environment is marked by volatile interest rates, inflationary pressures, and increasing capital costs.

Naturally, these factors have also significantly shifted how B2B buyers approach procurement and investment decisions. In times of cheap capital, companies prioritized growth at all costs, fueled by the easy availability of low-interest loans or investor capital. However, as the macroeconomic environment tightens, B2B buyers have become more conservative, prioritizing efficiency, cost savings, and long-term sustainability over aggressive expansion.

Sophisticated B2B buyers, therefore, are now focused on maximizing the ROI of every investment. They scrutinize vendors more thoroughly, looking for partners who can demonstrate a clear path to profitability and efficiency. The emphasis has shifted from just delivering innovation or growth to proving tangible, sustainable value.

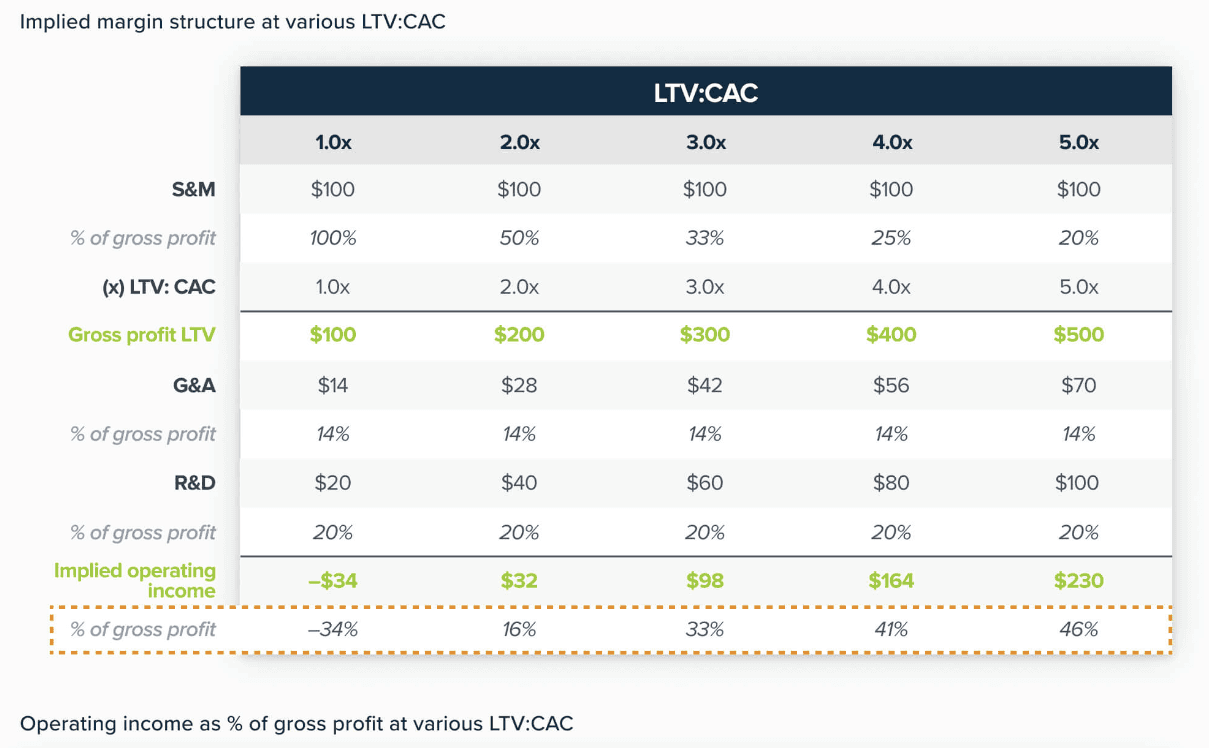

For B2B companies, this means that the long-term focus must be on efficiency: Maximizing Customer Lifetime Value (LTV), and thereby the value received by customers, whilst minimizing Customer Acquisition Costs (CAC).

In short, the macroeconomic shift has forced sophisticated B2B buyers to be more selective and cost-conscious, making it imperative for every B2B company to balance LTV against CAC. Focusing on profitability and efficiency ensures they remain competitive and attractive in a market where excess capital no longer fuels unchecked growth.

In this context, it is especially the relationship between CAC and LTV that is exceedingly important and must be carefully managed.

The reason is simple. If CAC is too high relative to LTV, a business loses its ability to generate cash reserves (aka profit) and as a consequence will burn through cash quickly. An unsustainable and dangerous strategy in a market where capital is expensive and less available.

On the other hand, this opens the possibility to outpace competition and thrive for those that achieve a strong ratio of at least 3:1 LTV/CAC.

This ratio means that for every euro spent on acquiring a customer (CAC), the company should generate at least three euros in customer lifetime value (LTV). This balance ensures that the business is not only growing, but also generating sufficient return on its marketing and sales investments to sustain long-term profitability and the ability to adapt to the market.

While everyone should be focused on increasing customer lifetime value and especially life-time gross profit (LTGP) by up/cross-selling your customers and leaning out operations, the reduction of customer acquisition cost (CAC) is even more important.

But decreasing CAC isn't just about cutting costs.

It is as much a function of cost as it is of driving efficiency along the sales funnel.

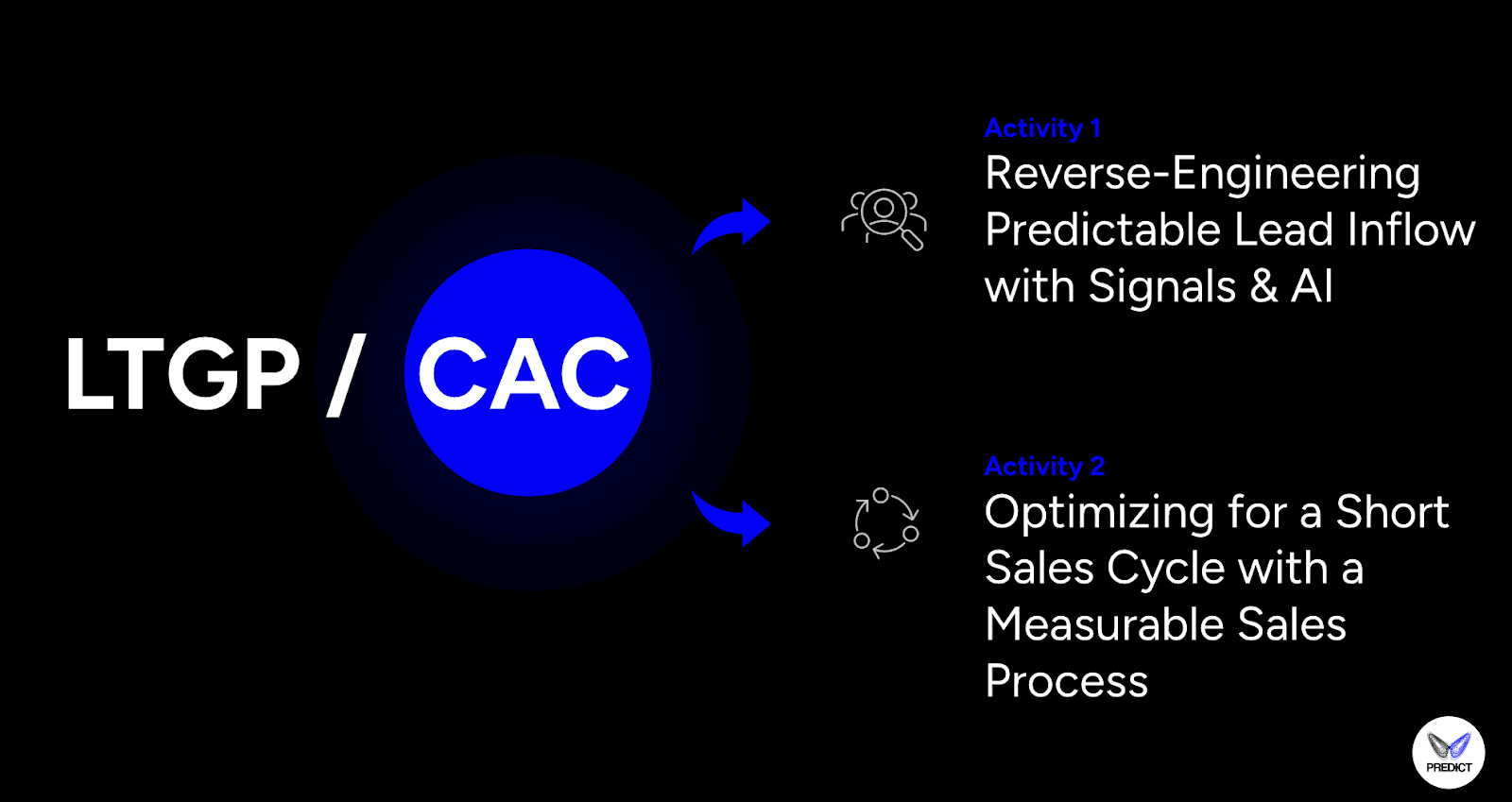

PREDICT Growth Model: The definite way to efficient growth & predictable new business sales.

The PREDICT Growth Model is the 2-step standard operating procedure we use with our clients to ensure that every B2B company can scale as efficiently and profitably as possible. It is based on data transparency, signals and AI allowing for the highest probability of success whilst reducing the risk of failure to a minimum.

To achieve this, we feed data points from your market, target audience and customers into our Signal Based data intelligence solution so that we can increase conversion rates across the funnel. In the next step we then continuously develop and test hypotheses to find the highest converting combinations of message + market, filling calendars with qualified meetings predictably.

This enables you to solve the forcing functions of the market and buy into an unfair advantage.

Solve your pipeline & new business problems now:

Activity 1: Reverse-Engineering Predictable Lead Inflow with Signals & AI

In the world of B2B sales with complex solutions, generating new customers begins with one essential step: Getting qualified meetings on the calendar.

While most Founders and Execs obsess over product features, pricing, or their next marketing initiative, the reality is that the number of possible meetings is dictated by three far more fundamental factors:

How many companies exist in your target market?

How many of them have an urgent problem you can solve?

Do they know who you are, and do they trust that you can help?

The answer to these questions is not only critical for understanding your growth potential in a strategic context but also for the efficient allocation of marketing resources.

But how can we answer these questions in a systematic and resource-efficient way?

Lets break down everything we do step by step.

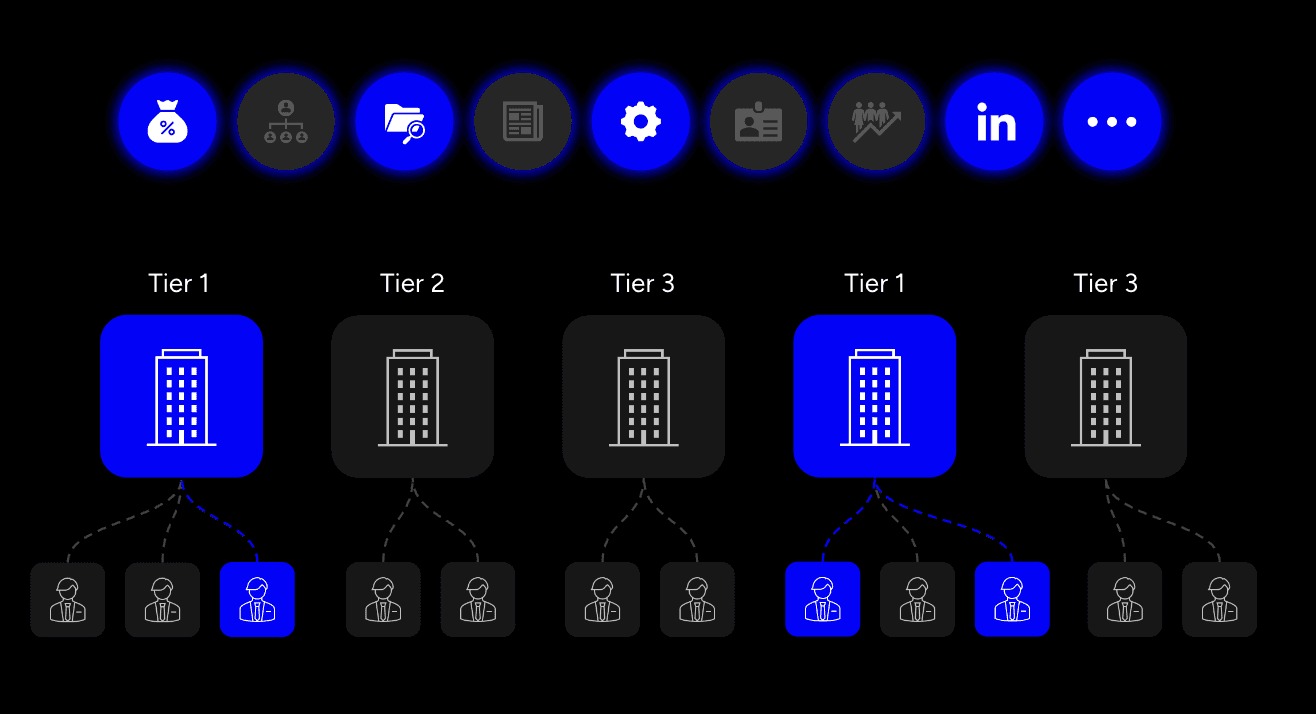

The first thing we do is to create full transparency over your target market.

Context and Explanation

Most of the B2B executives we speak with on a daily basis, have at best a rough idea of the companies in their target market in terms of industries, characteristics, and most relevant personas. Not ideal.

Therefore, first and foremost, we begin with generating a fully transparent and prioritized overview of your Total Addressable Market (TAM), determining the exact size and scope of the market your business can serve right now.

The list is then further refined, specified and prioritized using Signals - digital breadcrumbs that businesses and the people working in them leave day after day by broadcasting their needs, goals, and challenges publicly, and often unintentionally.

On the Importance of Signals

By performing a Signal-based TAM analysis we solve this problem from the ground up by incorporating real-time data and behavioral insights to prioritize companies & prospects based on actual, measurable signs of readiness.

By identifying companies that are actively demonstrating intent or exhibiting behaviors that align with your solution’s value proposition, you can direct your marketing efforts at the right person at the right time - dramatically improving conversion rates across the entire sales funnel.

For you, this means speaking with more people that are actually in demand of your solution every single week.

Before we can start conversations with this newly defined target audience, let's take a step back and remember that every top of funnel marketing activity has one goal: get a reaction.

A demo, a meeting, a reply—that’s it. To make this happen, we don’t need to pitch features or boast about benefits. That’s for later. Right now, we need to spark just enough interest for them to give us their time.

How? Relevance.Not vague, generic relevance.

We’re talking about the kind of relevance that makes your prospect feel like you’ve shadowed their workday. Like you’re in their head. Like you get them.

To do so we must start with creating an accurate and representative Ideal Customer Profile.

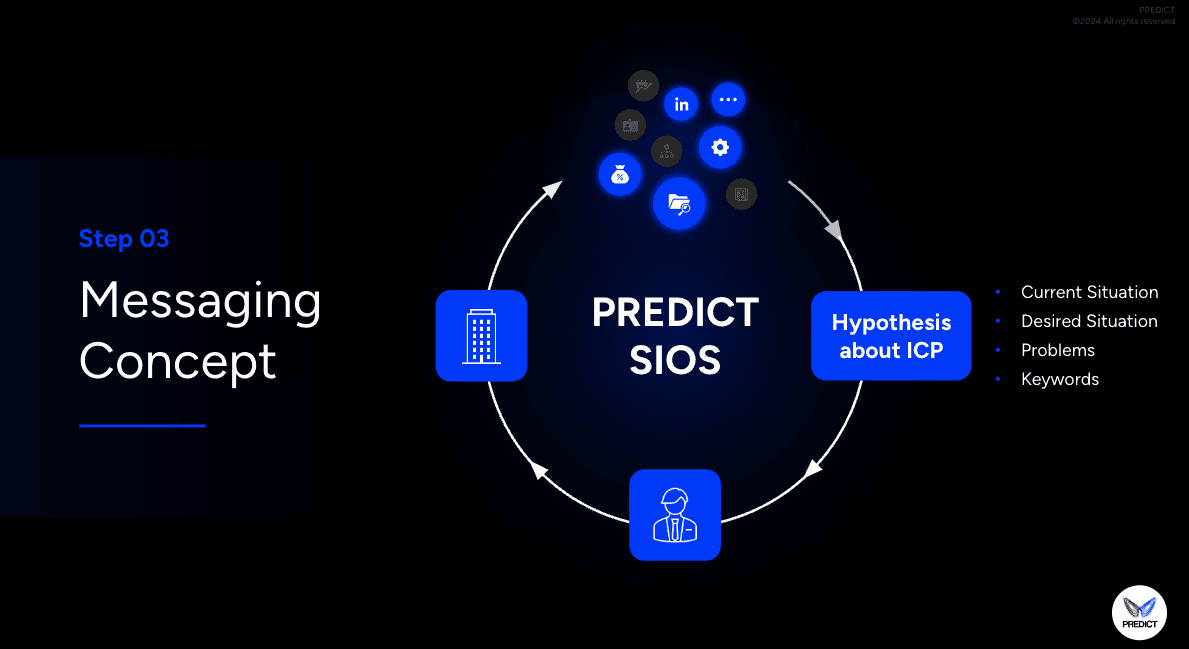

With a fully enriched TAM with all relevant signals and a crystal-clear ICP in mind you can now begin creating the messaging concept.

The importance of Relevance

Before we jump into the exact framework to use, remember this foundational rule: Relevance is everything. Your message needs to show your target audience that you understand their current reality—what’s keeping them up at night, what they’re up against, and where they want to go. The more you can make them feel like you’ve been walking in their shoes, the more likely they are to respond.

The reason for why this works is pretty straight forward. When your messaging is tailored to your ICP, grounded in relevance, and delivered at the right time, it stops being a cold email or LinkedIn message—it becomes a conversation starter. You’re not pushing your product or service; you’re offering a lifeline, a solution to a real problem they’re already thinking about.

Here’s how you do it:Address the ICP Directly:

Whether it’s the executive who’s frustrated with long sales cycles or the marketing lead who’s struggling to generate qualified leads, you need to speak directly to their role and what it means for them personally.

Timing is Key: Leverage signals. Are they expanding? Going through a merger? Hiring like crazy? Use these signals to time your outreach perfectly—so it feels like you’re showing up at the exact moment they need you.

With that in mind, let’s break down the messaging framework step by step.

Result: A Calendar full of Qualified Meetings

Activity 2: Optimizing for a shorter sales cycle by establishing a measurable & methodical B2B sales process

While the meeting is the first step to start a sales process when selling to sophisticated buyers, there are a lot more steps that need to be taken to go from a cold first relevant conversation to a hot opportunity that is ready to buy.

If we go back to our main hypothesis (LTV:CAC should be in a ratio of 3:1), then we need to identify what the main driver of CAC is in the sales process: The length of the sales cycle.

Understand that the length of the sales cycle heavily influences your customer acquisition cost because for every day that passes, you need to pay your experienced (and expensive) sales reps or spend your own time as a founder or executive (even more expensive) in numerous meetings, prepare workshops, travel to in person events, etc. Each of these interactions add to your Customer Acquisition Cost and take away from your bottom line - even if you’re unsure if the deal will even close.

By this logic, the worst case scenario you need to avoid is spending a significant amount of your time (and money) on deals which at the end do not convert - sadly, a reality that most B2B companies face every single quarter.

But it doesn’t have to be this way.

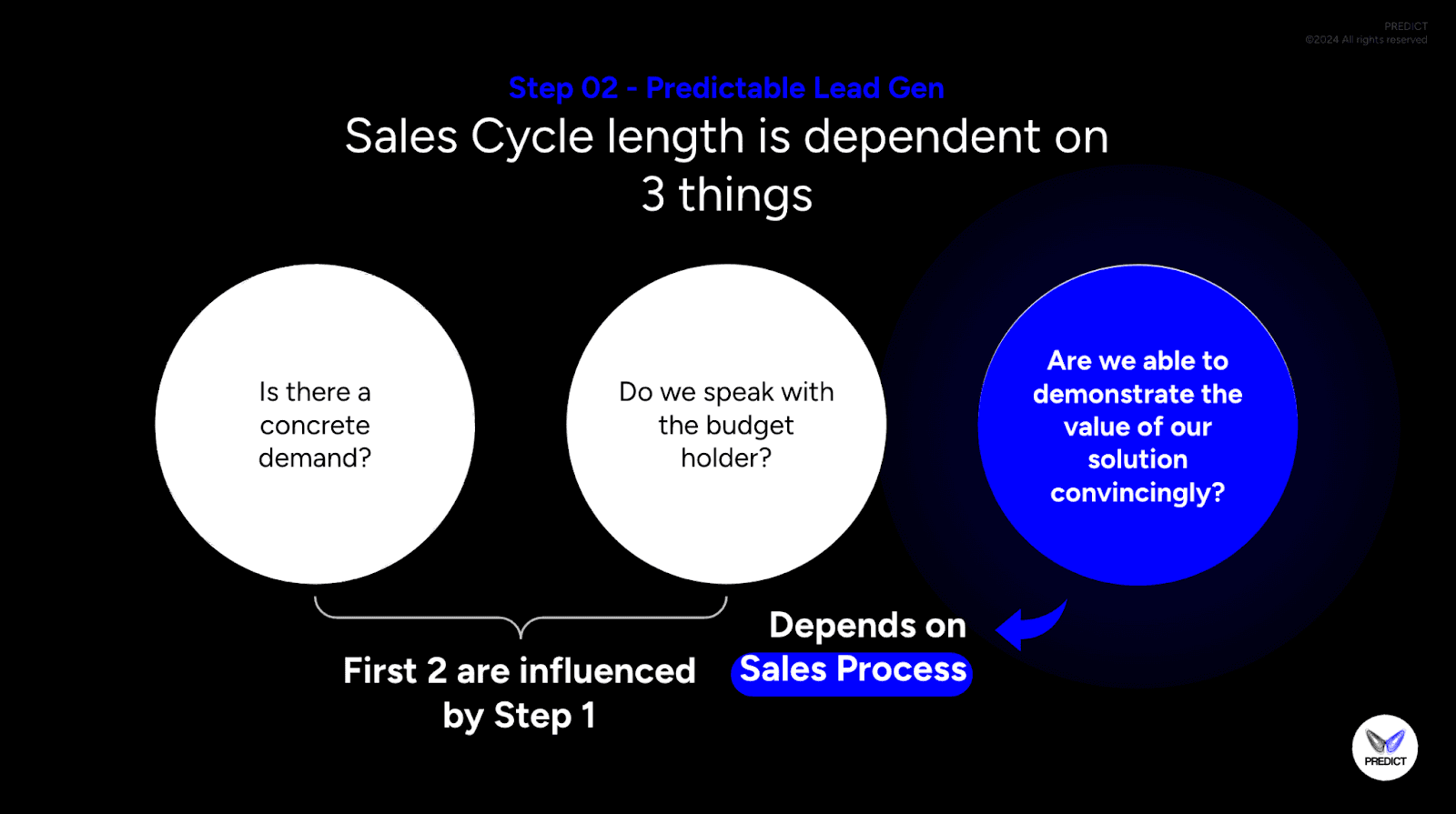

When going back to first principles, we see that there are 3 questions that influence the length of the sales cycle:

Does the company have a concrete demand / goal that has strategic and (C-Level) priority

Do you speak with the right economic buyer at the company that has or influences the budget decision

Are you able to demonstrate the value of your solution convincingly to all relevant stakeholders

If you’ve paid attention until now you will realize that, if we do Activity 1 correctly, this automatically means that the first 2 variables are given - BEFORE we start with our sales process.

We’re basically ⅔ of the way there already.

Therefore, in the following section we will concentrate our focus on giving you the tools and frameworks to master the third variable.

Creating a convincing Sales Argument for the sophisticated buyer

Creating a convincing sales argument for the sophisticated buyer can be broken down into three fundamental steps:

Getting Thesis Buyin

Establishing your Solution as the Vehicle

Methodically removing all obstacles to the deal

Lets go through these steps one by one.

Creating your “Thesis”

Selling to sophisticated buyers (as we do in B2B) requires that the prospect “buys into your thesis”. The thesis is the argument on which the feature hypotheses of the services and products were based.

The key concept is that if the prospect buys into your thesis, they will buy into your products and services. If the prospect doesn’t buy into the underlying thesis upon which the product features were hypothesized, then the prospect will never buy into the product or solution.

If the prospect buys into the thesis, then they will likely buy into the vehicle or product. If the prospect buys into your thesis more than a competitor, then you will win the business.

The best way to explain your thesis is with a visual diagram and rock-solid evidence. We use flow diagrams made with lucidchart:

PREDICT FlowchartsSolve your pipeline & new business problems now:

The outcome of the PREDICT Growth Model

Maximized LTV:CAC ratio, efficiency, profitability and EBITDA.

Compound Effect of Activity 1 and Activity 2, when iterated on real market feedback and implemented in the right order:

Calendar full of relevant sales meetings with only qualified personas in ICP companies –> higher pipeline value

Methodical sales process lead to shorter sales cycles → more new business deals faster at lower costs (=LTV:CAC ratio increases)

This ultimately results in a predictable new business engine & a high LTV:CAC ratio → crazy EBITDA & Valuation.